Current development potential

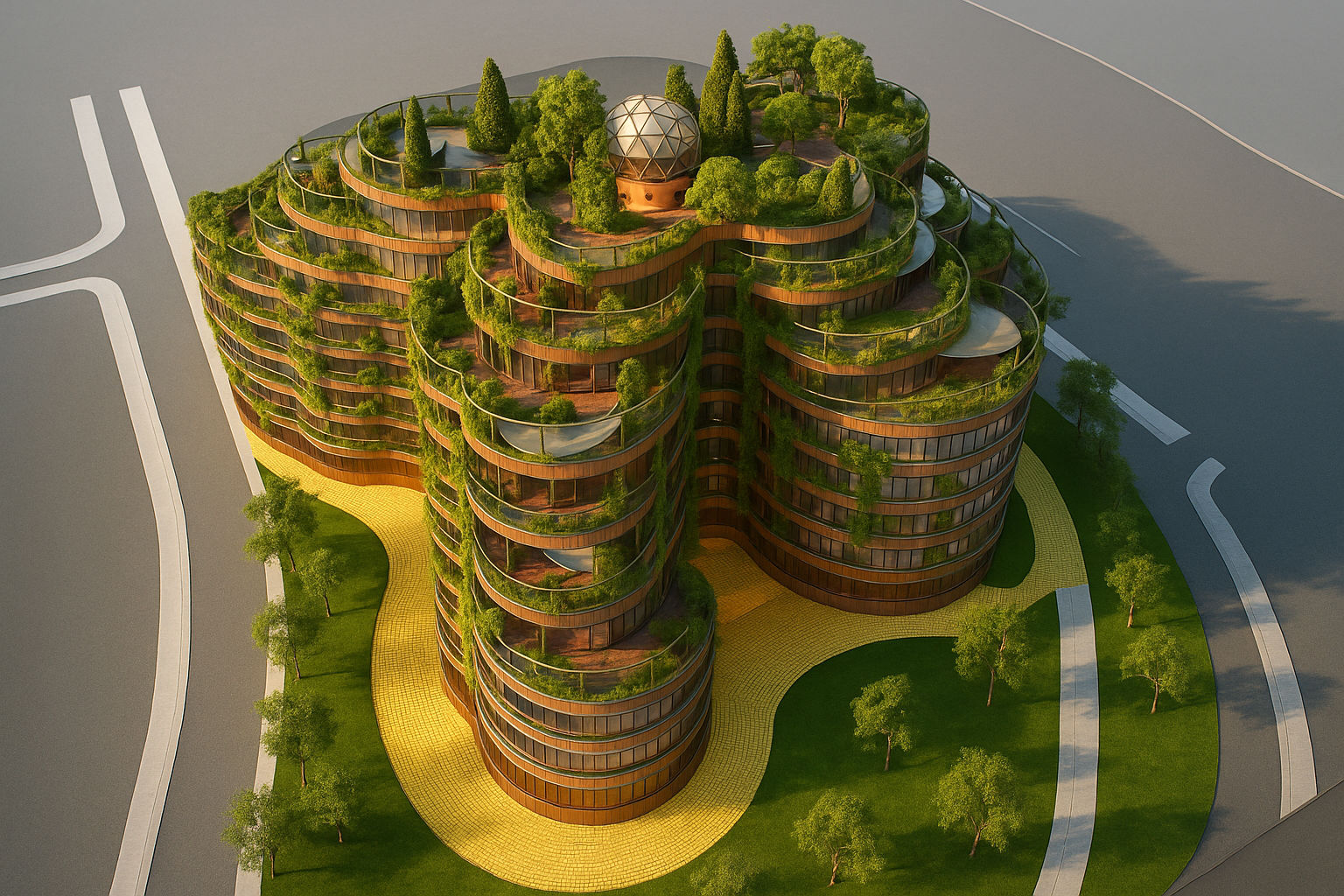

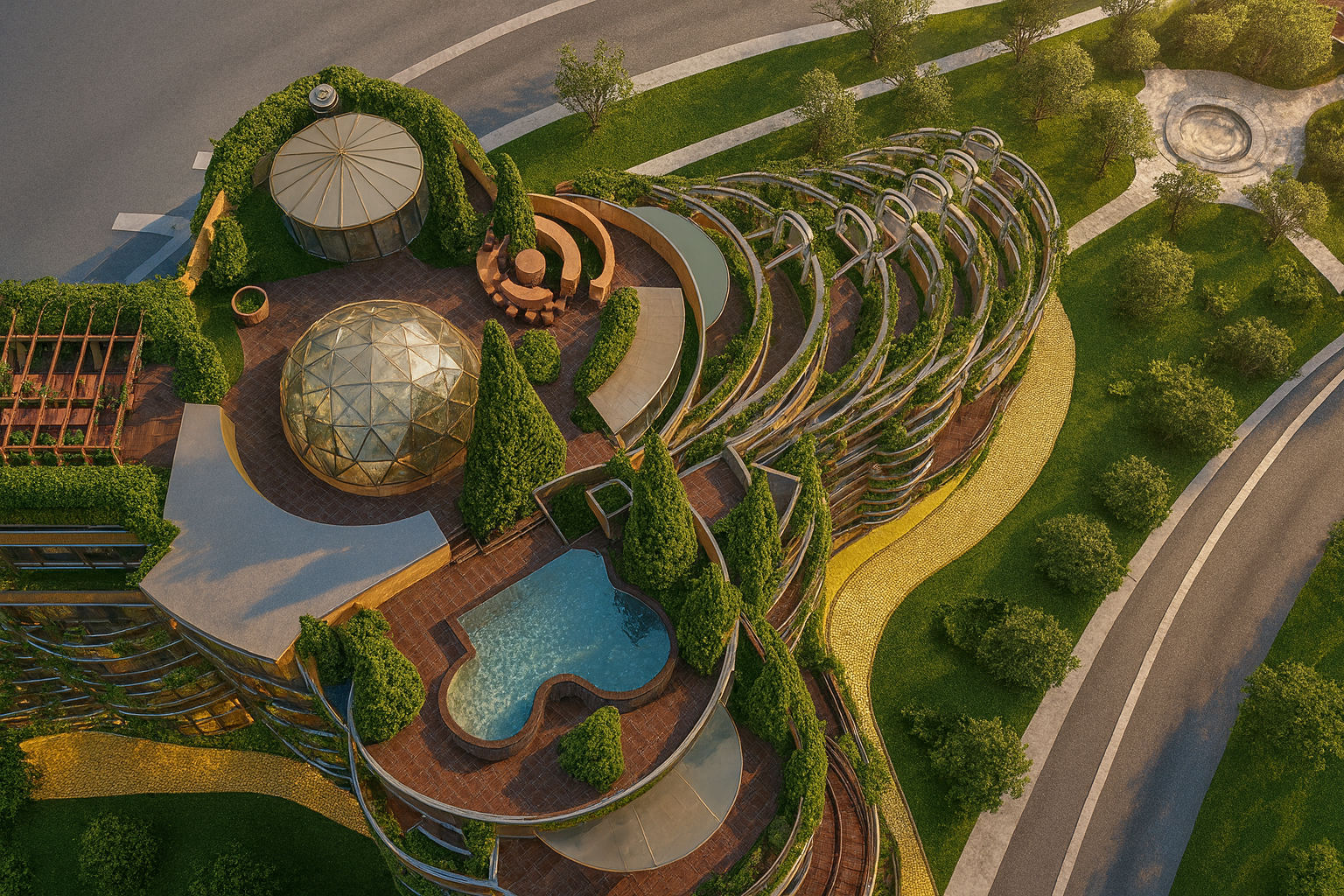

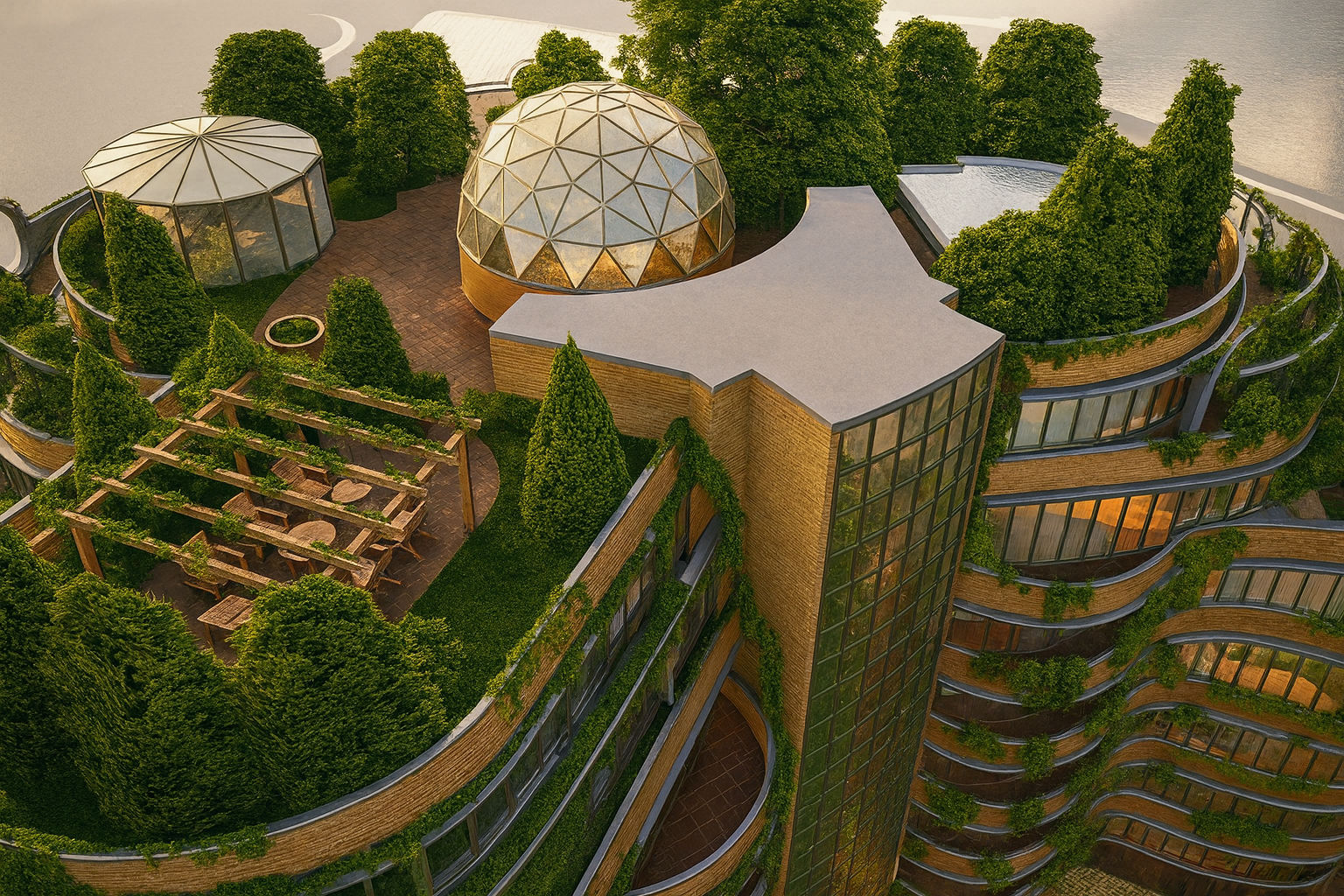

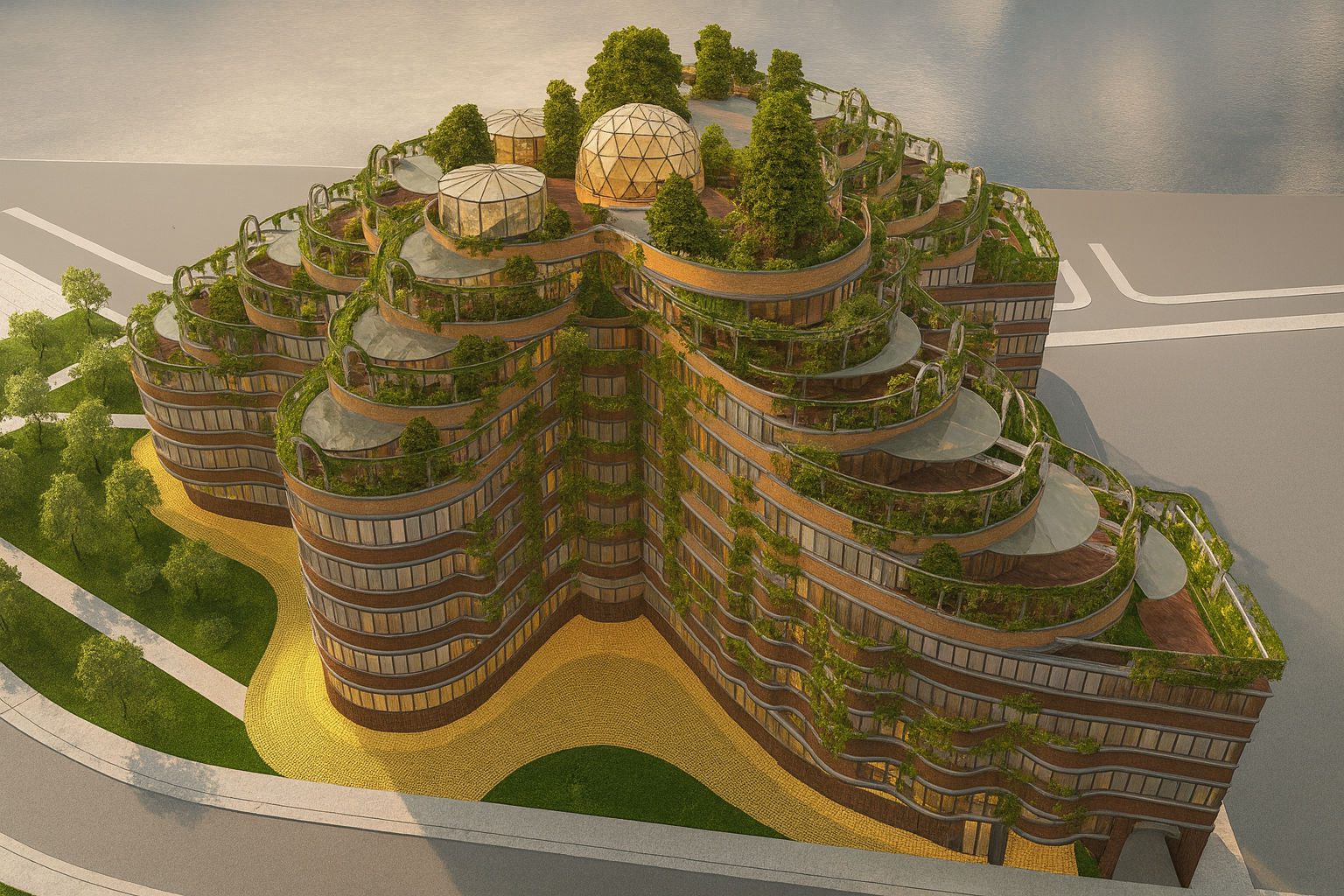

The distinct form of the MOJ DVOR residential building

113 apartments plus 185 parking spaces on three underground levels and technical services on ground floor. Building height: three underground and nine above-ground floors with a flat roof (3B+G+8), gross built area (GBA) 24,376.70 m².

Moj Dvor has been conceived as a “quarter within a quarter” – a place where everyday life, work, leisure and social interaction take place within one carefully designed, architecturally distinctive and technologically advanced ensemble, with a strong emphasis on greenery, comfort and safety. At the core of the project lies the idea of bringing high-quality urban living back to Zagreb’s wider city centre: the energy of the city outside, the feeling of a protected, private realm inside.

Architect and academician Andrija Mutnjaković designed a building with an irregular, dynamic form, combining greenery on terraces, winter gardens, panoramic lifts and a rooftop swimming pool. The concept responds to the view that urban living should not be reduced to “boxes of matches”, but should instead offer a more human, nature-inspired residential landscape in the very heart of Trešnjevka.

Key facts

- Address: Andrije Žaje 8, interface zone between Lower Town and Trešnjevka

- Plot size: 4,241 m²

- Use: Residential building

- Valid building permit: GBA = 24,376.70 m² / NSA = 12,323.48 m²

- Ownership of land, permit and project: 100% Moj dvor građenje d.o.o.

- Premium apartments across nine above-ground storeys

- Three underground levels of parking and storage

- Sports and ancillary commercial uses on the ground floor for residents

- The project is currently on hold, but construction can resume immediately under the valid building permit.

Under the amended General Urban Plan (GUP) of the City of Zagreb, adopted in September 2025, the permitted development capacity on the existing building plot has been significantly reduced.

Current situation

Publication of a misleading sale notice

Following the public call by Hrvatska poštanska banka (HPB) for expressions of interest in purchasing its receivables under the loan agreement with Moj dvor građenje d.o.o. (MDG), we provide below – in the interest of transparency – a brief overview of the key aspects of the situation.

We oppose the announced sale and have formally notified HPB of our position. We have also reported numerous irregularities to the competent supervisory authorities and requested that they act promptly and in line with their mandates.

In 2008, HPB and MDG – at that time a newly incorporated company without ongoing operations or operating

income – entered into a project financing agreement for the MOJ DVOR residential development.

HPB committed to finance the construction up to HRK 50 million (approx. one quarter of the total

investment), with the loan to be repaid exclusively from the sale of completed residential units as the

sole source of income.

As collateral for the facility, HPB took a mortgage over a very attractive and valuable development site

owned by MDG, while the bank’s real estate department exercised control over each disbursement from the

construction loan.

However, following the appointment of a new Management Board in autumn 2009, HPB stopped financing the construction. In early 2011, the bank unilaterally terminated the loan agreement and “declared” the loan immediately due and payable, despite contractual and legal provisions indicating otherwise. In practice, it was HPB’s own conduct that prevented completion of the building, the sale of apartments and the orderly repayment of the loan. Shortly afterwards, HPB initiated enforcement over the land by obtaining an enforcement clause on the mortgage agreement, notwithstanding that, as a bank, it knew or should have known that the loan had not validly fallen due.

The damage caused by HPB’s actions has been the subject of court proceedings, which have been reported in

the media on several occasions.

After three court decisions confirming that HPB had unlawfully terminated the loan agreement and breached

its contractual obligations – thereby causing damage to MDG – there was a major reversal: a higher

state court unexpectedly upheld a statute-of-limitations defence which the state-owned bank (HPB) raised

for the first time only after six years of litigation.

The sale notice now published by HPB, offering its claim (inflated by 16 years of interest on a loan that, was not validly accelerated) is just one in a long sequence of steps and behaviours the bank has taken over the 16-year period in which it has restricted our ability to dispose of the property and land. During this time, we have pursued – and continue to pursue – a number of court and administrative proceedings aimed at protecting MDG’s assets, based on arguments derived from contracts, legislation, by-laws and international conventions. We hope that MDG’s highly unusual experience of litigating against a state-controlled bank will help ensure that no citizen of the Republic of Croatia with a bank loan needs to fear for their property or spend 10–20 years in court to protect their rights.

Despite having been exposed over these 16 years to significant litigation costs, the risk of losing property and arbitrary decisions by courts, court administrations and the competent Ministry, we remain constructively optimistic and fully committed to protecting our rights and assets. In addition to ordinary legal remedies, we have even purchased a single HPB share at one point in order to challenge an allegedly unlawful general meeting, and we have – to our knowledge, for the first time in Croatia – sought to protect our rights by requesting access to the eSpis electronic court-file system in proceedings against HPB and by invoking the reasoning of the Court of Justice of the EU in the HANN-INVEST case (Joined Cases C‑554/21, C‑622/21 and C‑727/21). In both instances we were prevented from doing so, despite clear statutory grounds, but we will continue to pursue these avenues.

In its Call for expressions of interest, HPB stated that “The Bank’s receivable is secured by a lien over real estate as follows: mixed-use M2 building land in Zagreb, Trešnjevka, Andrije Žaje Street, plot area 4,241 m², with the possibility of constructing 24,376.70 m² of gross floor area” which is false and misleading, as HPB does not hold a mortgage or any other right over MDG’s building permit or project documentation.

By presenting its receivable as if it were selling “the Moj Dvor project including land and permit”, HPB creates the false impression of a bundled acquisition opportunity that, in reality, does not exist.

What HPB is actually selling

- A bank receivable that has, been unlawfully inflated and, under the agreed terms, has not validly fallen due.

- The receivable in question is the subject of ongoing court proceedings.

- The legal position of the creditor (HPB) vis-à-vis the debtor (MDG), allowing recovery solely from the value of the mortgaged land – but not a guaranteed acquisition of the property itself.

A purchaser of this NPL acquires a disputed, inflated and not validly accelerated receivable – they do not acquire the land, the project, the permit or the full development potential which HPB suggests in its Call.

HPB does not, in any form, control the valid building permit or the development rights of the property, notwithstanding the contrary impression created in the Call.

Location

Moj Dvor – Zagreb

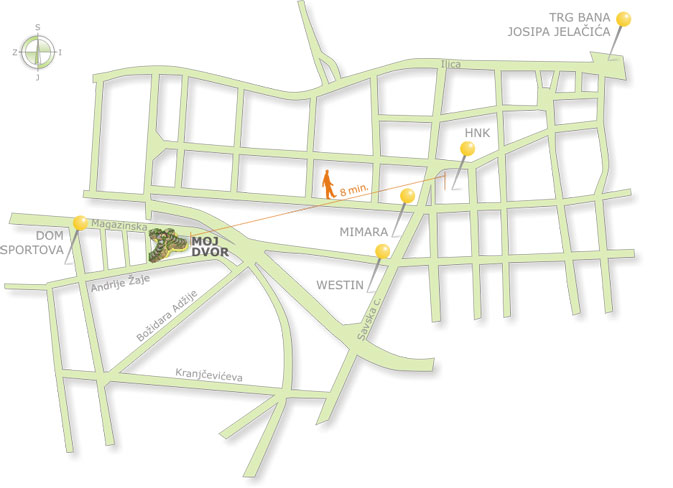

The Moj Dvor project is located in the interface zone between Zagreb’s Lower Town (Donji grad) and Trešnjevka, in the wider city centre, at Andrije Žaje 8, with easy access to major city roads and public transport.